CASHe Instant Personal loans ranging from Rs.10000 to Rs.100,000 Without Paperwork

CASHe for the timely EMI payment for securing monthly bills, making a major purches that you should desired,taking vacation to unwind for meeting a medical of financial emergency,keep the power of CASHe in your smartphone. Quick personal loan from CASHe that help you stitch in time.

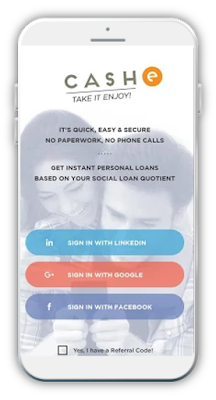

CASHe, a cutting fintech product from TSLC PTE. LTD provide short term personal loan to young salaried profession single yet powerful app. powered by property predictive algorithm called the social loan Quotient (SLQ) that's create a sophistiated credit profile for consumer totally different from the convention banks and credit agencies. CASHe enables young professional to get loan within a minute no paperwork and pain.

CASHe now available loans ranging from Rs 10000 to Rs. 300,000 for 60+7, 90 & 180, 270 days amd one year plan based on your every changing needs. all you require is a salary slip,bank statement,PAN card,address proof on the self signed white paper and upload through cash app in your bank account within a minute.

CASHe is India's most preferred digital lending company for young salaried millennials. CASHe provides instant short-term personal loans to young professionals based on their social profile, merit and earning potential using its proprietary algorithm based machine learning platform. Powered by its industry-first proprietary algorithm-driven credit scoring platform, Social Loan Quotient (SLQ), CASHe quickly determines a user’s credit worthiness by using multiple unique data points to arrive at a distinct credit profile of the customer.

CASHe is completely automated and requires no personal intervention and no physical documentation. The average time taken for a loan to be disbursed is about 10 minutes, subject to proper documentation.

CASHe currently provides instant personal loans to salaried professionals with a minimum salary of Rs 12,000/-

What You'll Love

● Avail instant loans from CASHe through your smartphone

● Completely Digitised: Few documents to upload on the application

● Get instant cash loans from as little as Rs 7,000

● Gets loans ranging from Rs.7,000 – 80,000 for 62 days, Rs. 19,000 – 1,00,000 for 90 days & 25,000 – 2,00,000 for 180 days.

● Faster approval process with less documentation.

● Get collateral-free loans without any bank visits or phone calls

● Attractive rate of interests

● Flexi repayment methods.

● Loan disbursement in 10 minutes

● Multiple Repayment options: A choice of repayment options ranging from 62 days, 90 days, 180 days, 270 days and 360 days

● Loans at 24.33%-36.50% p.a. translating to 2% - 3% a month

personal loan

Rate of Interest:

● Interest rate for loan tenure 62 days: 36.50% p.a.(APR)

● Interest rate for loan tenure 90 days: 33.46% p.a.(APR)

● Interest rate for loan tenure 180 days: 30.42% p.a.(APR)

● Interest rate for loan tenure 270 days: 31.42% p.a.(APR)

● Interest rate for loan tenure 360 days: 24.33% p.a.(APR)

● Multiple Loan Options: Choose from a variety of loan options from Rs 7,000 to Rs 3,00,000

Loan Calculation:

Sample loan calculation-

Loan amount : 30,000 INR at interest rate of 33% p.a.

Loan Duration : 90 Days

Total Interest = 2475 INR

Processing fees (PF) + GST= 600 INR + 108 INR = 708 INR

Total Deductibles (PF + GST+ Interest): 3183 INR

InHand Amount: Loan Amount - Total Deductibles = 30000 - 3183 = 26817 INR

Total repayable Amount: 30000 INR

Monthly EMI Repayable : 10000 INR

** The deductibles (interest + PF + GST) is deducted upfront during the loan disbursal.

Eligibility criteria:

Minimum salary in hand: Rs 12,000/-

Documents required:

● A Self Signed PAN Card, Aadhar Card

● Latest Salary Slip

● Updated Salary Bank Account Statement

● Any Address Proof (Current and Permanent)

● A selfie and a company id.

Application Link: https://play.google.com/

CASHe for the timely EMI payment for securing monthly bills, making a major purches that you should desired,taking vacation to unwind for meeting a medical of financial emergency,keep the power of CASHe in your smartphone. Quick personal loan from CASHe that help you stitch in time.

CASHe, a cutting fintech product from TSLC PTE. LTD provide short term personal loan to young salaried profession single yet powerful app. powered by property predictive algorithm called the social loan Quotient (SLQ) that's create a sophistiated credit profile for consumer totally different from the convention banks and credit agencies. CASHe enables young professional to get loan within a minute no paperwork and pain.

CASHe now available loans ranging from Rs 10000 to Rs. 300,000 for 60+7, 90 & 180, 270 days amd one year plan based on your every changing needs. all you require is a salary slip,bank statement,PAN card,address proof on the self signed white paper and upload through cash app in your bank account within a minute.

CASHe is India's most preferred digital lending company for young salaried millennials. CASHe provides instant short-term personal loans to young professionals based on their social profile, merit and earning potential using its proprietary algorithm based machine learning platform. Powered by its industry-first proprietary algorithm-driven credit scoring platform, Social Loan Quotient (SLQ), CASHe quickly determines a user’s credit worthiness by using multiple unique data points to arrive at a distinct credit profile of the customer.

CASHe is completely automated and requires no personal intervention and no physical documentation. The average time taken for a loan to be disbursed is about 10 minutes, subject to proper documentation.

CASHe currently provides instant personal loans to salaried professionals with a minimum salary of Rs 12,000/-

What You'll Love

● Avail instant loans from CASHe through your smartphone

● Completely Digitised: Few documents to upload on the application

● Get instant cash loans from as little as Rs 7,000

● Gets loans ranging from Rs.7,000 – 80,000 for 62 days, Rs. 19,000 – 1,00,000 for 90 days & 25,000 – 2,00,000 for 180 days.

● Faster approval process with less documentation.

● Get collateral-free loans without any bank visits or phone calls

● Attractive rate of interests

● Flexi repayment methods.

● Loan disbursement in 10 minutes

● Multiple Repayment options: A choice of repayment options ranging from 62 days, 90 days, 180 days, 270 days and 360 days

● Loans at 24.33%-36.50% p.a. translating to 2% - 3% a month

personal loan

Rate of Interest:

● Interest rate for loan tenure 62 days: 36.50% p.a.(APR)

● Interest rate for loan tenure 90 days: 33.46% p.a.(APR)

● Interest rate for loan tenure 180 days: 30.42% p.a.(APR)

● Interest rate for loan tenure 270 days: 31.42% p.a.(APR)

● Interest rate for loan tenure 360 days: 24.33% p.a.(APR)

● Multiple Loan Options: Choose from a variety of loan options from Rs 7,000 to Rs 3,00,000

Loan Calculation:

Sample loan calculation-

Loan amount : 30,000 INR at interest rate of 33% p.a.

Loan Duration : 90 Days

Total Interest = 2475 INR

Processing fees (PF) + GST= 600 INR + 108 INR = 708 INR

Total Deductibles (PF + GST+ Interest): 3183 INR

InHand Amount: Loan Amount - Total Deductibles = 30000 - 3183 = 26817 INR

Total repayable Amount: 30000 INR

Monthly EMI Repayable : 10000 INR

** The deductibles (interest + PF + GST) is deducted upfront during the loan disbursal.

Eligibility criteria:

Minimum salary in hand: Rs 12,000/-

Documents required:

● A Self Signed PAN Card, Aadhar Card

● Latest Salary Slip

● Updated Salary Bank Account Statement

● Any Address Proof (Current and Permanent)

● A selfie and a company id.

Post a Comment