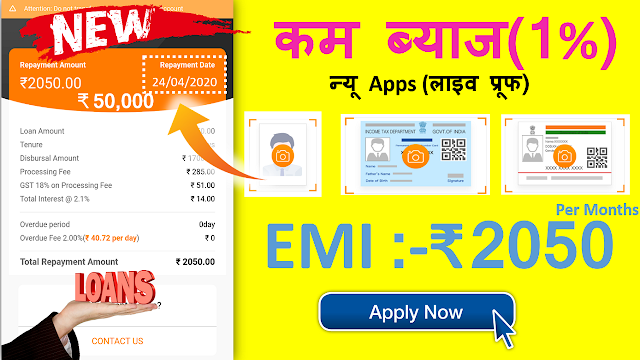

iCredit Instant Personal Cash Loan Application /Loan Without Salary Slip or Bank Statements / Get ₹ 5,000 - ₹ 50,000 Apply Online -with iCredit

Application Link : https://play.google.com/

iCredit, provides short-term personal loans via a simple yet powerful mobile APP. Our products are delicately curated only after understanding that not everything in your life could be planned and you could need money at short notice for some small yet urgent daily needs. Hence,iCredit tech-driven system enables young & old applicants to quickly get loan within minutes without paperwork & hurdles. Our company has now over 300 employees with its operations spread across each city across all states & UTs of India. Company aims to venture into more innovative products along with focus on superior user experience and value to shareholders.

iCredit understand your ever-changing needs & uncertainties life can throw at you like, medical emergencies, repairs, travel, meeting cash shortfalls for big-ticket purchases etc & hence we have designed this simple personal loan product with a loan limit of up to INR 50,000 keeping your needs in mind. Compared to the complicated and long application process in banks & other financial institutions, iCredit is quick and as easy as ordering a pizza!

HOW IT WORKS:

1. Check Eligibility

You just have to fill some basic information to see if you are eligible for a loa

2. Complete Profile

Submit your basic information including KYC documents

3. Get Instant Loan

When loan gets approved, Money is instantly deposited to your bank account

iCredit Loan benefits:

- No credit history required

- 100% online

- Available in all Indian cities

- Fast processing

Loan amount:

₹ 5,000.00 - ₹ 50,000.00

Loan tenure:

91 days (shortest, including renewal time) - 120 days (longest, including renewal time)

Maximum APR:

20%

Transaction Fee: 0

Other fees: iCredit will charge one time sign fee, service fee(per transaction). Minimum 10%, Maximum 20%

User Requirements

Age : 21+

Interest calculation

If your loan amount is ₹ 10,000, APR is 20%,service fee is 10% and the term is 91 days. on the due date, the amount payable is ₹ 11,498.6 (10,000 * 20% / 365 * 91 + 10,000 + 10,000*10%).

If your loan amount is ₹ 10,000, APR is 20%,service fee is 20% and the term is 91 days. on the due date, the amount payable is ₹ 12,498.6 (10,000 * 20% / 365 * 91 + 10,000 + 10,000*20%).

₹ 5,000.00 - ₹ 50,000.00

Loan tenure:

91 days (shortest, including renewal time) - 120 days (longest, including renewal time)

Maximum APR:

20%

Transaction Fee: 0

Other fees: iCredit will charge one time sign fee, service fee(per transaction). Minimum 10%, Maximum 20%

User Requirements

Age : 21+

Interest calculation

If your loan amount is ₹ 10,000, APR is 20%,service fee is 10% and the term is 91 days. on the due date, the amount payable is ₹ 11,498.6 (10,000 * 20% / 365 * 91 + 10,000 + 10,000*10%).

If your loan amount is ₹ 10,000, APR is 20%,service fee is 20% and the term is 91 days. on the due date, the amount payable is ₹ 12,498.6 (10,000 * 20% / 365 * 91 + 10,000 + 10,000*20%).

PHONE:

+91 9953020829

EMAIL:

service@i-credit.in

WEBSITE:

http://www.i-credit.in

ADDRESS:

2, Floor 2, Plot772,

Shree Ram Bhavan,

Parsi, Colony 4th Road,

Parsi Colony, Dadar (E),

MUMBAI-400014

Post a Comment